Strategic Decisions: When Spectrum Deals Emerge

Share

Last week highlighted the importance of having access to a spectrum database and analysis tool that is capable of modeling announced transactions. There were several things that our customers were able to see.

In the Echostar/AT&T transaction, our customers were able to identify the markets and amount of spectrum that Echostar controlled by a variety of market types include county and PEA markets. Below is the spectrum held by Echostar (Dish) in each of the Top 20 PEA markets.

600MHz Spectrum by PEA Market:

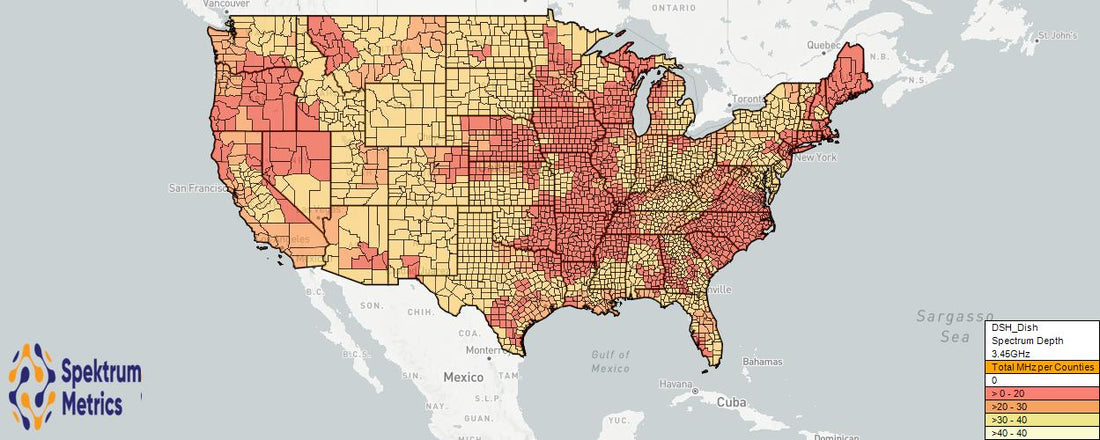

3.45GHz Spectrum by PEA Market:

With the Spectrum Ownership Analysis Tool, our customers can assign Dish's 600MHz and 3.45GHz spectrum to AT&T. This allows the transaction to be evaluated in our spectrum screen analysis and to see the effect on the National Population Averaged Spectrum Depth for the National Carriers.

600MHz Spectrum by PEA Market:

3.45GHz Spectrum by PEA Market:

Before Transaction:

In the After Transaction view AT&T's 3.45GHz national average spectrum holdings increased from 44MHz to 74MHz.

After Transaction:

As we modeled the movement of spectrum from Echostar to AT&T, we also discovered that Dish has a pending transaction with Omega Wireless (Cypress Wireless) purchasing their 600MHz and selling some of Echostar's 3.45GHz spectrum. Whether this spectrum is included in the AT&T/Echostar deal will need to be evaluated when additional details are made public.

We can see the effect of the Omega Wireless 600MHz transaction in the MHzPOPs summary.

As spectrum deals are rumored or announced, it is critical that the decision makers in your company have the data available to understand and respond to the new competitive environment. Spektrum Metrics has been providing spectrum ownership insights to our customers for nearly 15 years and we continue to assist our customers in evaluating how spectrum ownership changes will affect their businesses, products, and services.