Spectrum Blog

Filter by

Tags ×

- 12.2GHz

- 1800MHz

- 2.5

- 2.5GHz

- 2100MHz

- 2300MHz

- 24GHz

- 2500MHz

- 28GHz

- 3.3GHz

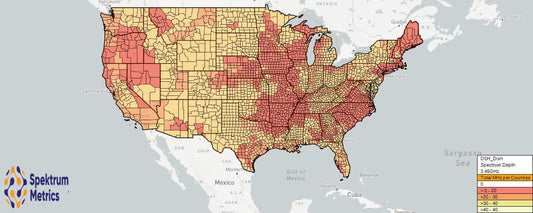

- 3.45GHz

- 3.5GHz

- 31GHz

- 3500MHz

- 37GHz

- 39GHz

- 3GPP

- 47GHz

- 5G

- 600MHz

- 700MHz

- 800MHz

- 900MHz

- Agri-Valley Communication

- AllNet Labs

- AT&T

- ATNI

- ATT

- Auction

- Auction 105

- Auction 108

- Auction 110

- AWS

- AWS-3

- AWS2

- AWS3

- AWS4

- AWS5

- Axtel

- Band 38

- Band 41

- Band Class

- Bell Mobile

- Bell Mobility

- Bharti Airtel

- Blackrock

- Blue Ridge Wireless

- BNSL

- Bragg

- Broadband Incentive

- BRS

- BTA

- C Spire

- C-band

- CableOne

- Canada

- Carrier Aggregation

- Cass Cable

- Cavalier

- CBRS

- CBS

- Cellular

- Channel 51

- Channel Block

- Charter

- China Mobile

- Claro

- Clearwire

- Cogeco

- Columbia Capital

- Comcast

- Cox

- Cross Wireless

- Cypress

- Data

- DISH

- Dish Anywhere

- Duono

- Eastlink Wireless

- EBS

- EBS Auction

- Echostar

- EMBMS

- Ericsson

- FCC

- FDD-LTE

- FiberTower

- FirstNet

- Freedom

- Geneseo Communications

- GLG

- Globalstar

- Go Long Wireless

- Grain

- GSA

- Hawaii

- IFT

- Iowa Wireless

- Iris

- LAA

- Leap

- Liberty

- Licensed POPs

- LMDS

- LTE

- LTE Advance

- LTE Band

- LTE Band Class

- LTE Broadcast

- M&M Brothers

- MBS

- MetroPCS

- Mexico

- MHz-POPS

- Michigan Wireless

- Millimeter Wave

- MIMO

- MVDDS

- MVNO

- NextLink

- NFL

- Northstar

- NR

- NR Band Analysis

- Off-loading

- Orion Wireless

- PAL

- PCS

- PCS G

- PCS H

- Plateau Telecommunications

- PSA

- Qualcomm

- RCR

- Red Mayorista

- Reliance Jio

- Remapping

- Rogers

- RRH

- RSA Access

- Rulemaking

- Sagebrush Cellular

- SAS

- Sasktel

- Shenandoah

- Skyriver

- Small Cell

- Small Cells

- SNR

- Softbank

- SpaceX

- Spectrum

- Spectrum Ownership Analysis Tool

- Spectrum Ownership Mapping

- Spectrum Screen

- Spectrum Transactions

- SpectrumCo

- Sprint

- SSI Micro

- Starry

- Straight Path

- T-Mobile

- TBayTel

- TDD-LTE

- Telcel

- Telefonica

- Telmex

- Telus

- Terrestar

- TLPS

- Tribal

- TV Zac

- Ultravision

- United States

- Upper Microwave

- Usage

- USCellular

- Verizon

- Videotron

- Vodafone Idea

- VOIP

- VoLTE

- WCS

- Web Spectrum Viewer

- White Space

- Whitespace

- WiFi

- Xplore

- Xplornet

Strategic Decisions: When Spectrum Deals Emerge

Last week highlighted the importance of having access to a spectrum database and analysis tool that is capable of modeling announced transactions. There were several things that our customers were...

Strategic Decisions: When Spectrum Deals Emerge

Last week highlighted the importance of having access to a spectrum database and analysis tool that is capable of modeling announced transactions. There were several things that our customers were...

Evaluating the Effects of FCC Spectrum Transact...

Spektrum Metrics produces a weekly Spectrum Transactions Summary email that details the transactions that were filed that week by wireless carriers at the FCC. Referring to this recent Transactions Summary, I am...

Evaluating the Effects of FCC Spectrum Transact...

Spektrum Metrics produces a weekly Spectrum Transactions Summary email that details the transactions that were filed that week by wireless carriers at the FCC. Referring to this recent Transactions Summary, I am...

Evaluating Spectrum Screens by Band Classificat...

Recently the FCC opened a comment period regarding an AT&T petition to establish a mid-band spectrum screen. I thought this would be a good opportunity to look at the spectrum screen...

Evaluating Spectrum Screens by Band Classificat...

Recently the FCC opened a comment period regarding an AT&T petition to establish a mid-band spectrum screen. I thought this would be a good opportunity to look at the spectrum screen...

Market Spectrum Screens for the US National Car...

The recent news highlighting a FCC proceeding into the spectrum screen referenced, some analysis by Raymond James establishing T-Mobile dominance with 350MHz of spectrum on average in the nation's top markets....

Market Spectrum Screens for the US National Car...

The recent news highlighting a FCC proceeding into the spectrum screen referenced, some analysis by Raymond James establishing T-Mobile dominance with 350MHz of spectrum on average in the nation's top markets....

3.45GHz Auction Results

On Friday, the FCC posted the results from Auction 110. On Saturday we updated the January 2021 release of our Mobile Carrier - Spectrum Ownership Analysis Tool to reflect the auction...

3.45GHz Auction Results

On Friday, the FCC posted the results from Auction 110. On Saturday we updated the January 2021 release of our Mobile Carrier - Spectrum Ownership Analysis Tool to reflect the auction...

How much spectrum does Dish have for its Las Ve...

Last month Light Reading re-published results from Signals Research Group's testing of Dish's first 5G network in Las Vegas. Signals Research indicated that Dish is using 5MHz of their AWS-3 spectrum,...

How much spectrum does Dish have for its Las Ve...

Last month Light Reading re-published results from Signals Research Group's testing of Dish's first 5G network in Las Vegas. Signals Research indicated that Dish is using 5MHz of their AWS-3 spectrum,...