Spectrum Blog

Filter by

Tags ×

- 12.2GHz

- 1800MHz

- 2.5

- 2.5GHz

- 2100MHz

- 2300MHz

- 24GHz

- 2500MHz

- 28GHz

- 3.3GHz

- 3.45GHz

- 3.5GHz

- 31GHz

- 3500MHz

- 37GHz

- 39GHz

- 3GPP

- 47GHz

- 5G

- 600MHz

- 700MHz

- 800MHz

- 900MHz

- Agri-Valley Communication

- AllNet Labs

- AT&T

- ATNI

- ATT

- Auction

- Auction 105

- Auction 108

- Auction 110

- AWS

- AWS-3

- AWS2

- AWS3

- AWS4

- AWS5

- Axtel

- Band 38

- Band 41

- Band Class

- Bell Mobile

- Bell Mobility

- Bharti Airtel

- Blackrock

- Blue Ridge Wireless

- BNSL

- Bragg

- Broadband Incentive

- BRS

- BTA

- C Spire

- C-band

- CableOne

- Canada

- Carrier Aggregation

- Cass Cable

- Cavalier

- CBRS

- CBS

- Cellular

- Channel 51

- Channel Block

- Charter

- China Mobile

- Claro

- Clearwire

- Cogeco

- Columbia Capital

- Comcast

- Cox

- Cross Wireless

- Cypress

- Data

- DISH

- Dish Anywhere

- Duono

- Eastlink Wireless

- EBS

- EBS Auction

- Echostar

- EMBMS

- Ericsson

- FCC

- FDD-LTE

- FiberTower

- FirstNet

- Freedom

- Geneseo Communications

- GLG

- Globalstar

- Go Long Wireless

- Grain

- GSA

- Hawaii

- IFT

- Iowa Wireless

- Iris

- LAA

- Leap

- Liberty

- Licensed POPs

- LMDS

- LTE

- LTE Advance

- LTE Band

- LTE Band Class

- LTE Broadcast

- M&M Brothers

- MBS

- MetroPCS

- Mexico

- MHz-POPS

- Michigan Wireless

- Millimeter Wave

- MIMO

- MVDDS

- MVNO

- NextLink

- NFL

- Northstar

- NR

- NR Band Analysis

- Off-loading

- Orion Wireless

- PAL

- PCS

- PCS G

- PCS H

- Plateau Telecommunications

- PSA

- Qualcomm

- RCR

- Red Mayorista

- Reliance Jio

- Remapping

- Rogers

- RRH

- RSA Access

- Rulemaking

- Sagebrush Cellular

- SAS

- Sasktel

- Shenandoah

- Skyriver

- Small Cell

- Small Cells

- SNR

- Softbank

- SpaceX

- Spectrum

- Spectrum Ownership Analysis Tool

- Spectrum Ownership Mapping

- Spectrum Screen

- Spectrum Transactions

- SpectrumCo

- Sprint

- SSI Micro

- Starry

- Straight Path

- T-Mobile

- TBayTel

- TDD-LTE

- Telcel

- Telefonica

- Telmex

- Telus

- Terrestar

- TLPS

- Tribal

- TV Zac

- Ultravision

- United States

- Upper Microwave

- Usage

- USCellular

- Verizon

- Videotron

- Vodafone Idea

- VOIP

- VoLTE

- WCS

- Web Spectrum Viewer

- White Space

- Whitespace

- WiFi

- Xplore

- Xplornet

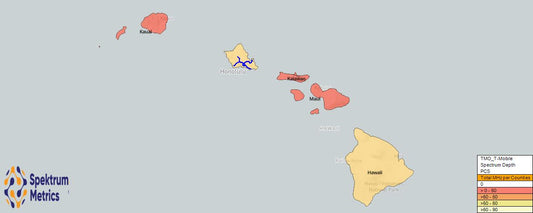

T-Mobile's Spectrum Deal: Did It Happen?

Over 18 months ago, in the lead up to Auction 108, we wrote about a T-Mobile agreement to reduce their spectrum holdings in Hawaii to resolve a concern about their...

T-Mobile's Spectrum Deal: Did It Happen?

Over 18 months ago, in the lead up to Auction 108, we wrote about a T-Mobile agreement to reduce their spectrum holdings in Hawaii to resolve a concern about their...

US Cellular: What Spectrum Remains?

Below is a broad overview of the spectrum assets USCellular held prior to offering its self for sale (in MHzPOPs) and how those assets have been distributed through acquiring carrier...

US Cellular: What Spectrum Remains?

Below is a broad overview of the spectrum assets USCellular held prior to offering its self for sale (in MHzPOPs) and how those assets have been distributed through acquiring carrier...

Interference to PCS Channels from SpaceX

On August 16th, AT&T filed a petition to deny SpaceX's waiver request that would allow SpaceX to operate from space on T-Mobile's PCS G channels. From the Web Spectrum Viewer...

Interference to PCS Channels from SpaceX

On August 16th, AT&T filed a petition to deny SpaceX's waiver request that would allow SpaceX to operate from space on T-Mobile's PCS G channels. From the Web Spectrum Viewer...

Why is T-Mobile Giving Up Spectrum in Hawaii?

T-Mobile made commitments to the FCC in the Memorandum Opinion and Order in their application for their Auction 108 (2.5 GHz Band Licenses). T-Mobile committed to divest by sale or swap, 20...

Why is T-Mobile Giving Up Spectrum in Hawaii?

T-Mobile made commitments to the FCC in the Memorandum Opinion and Order in their application for their Auction 108 (2.5 GHz Band Licenses). T-Mobile committed to divest by sale or swap, 20...

Evaluating Spectrum Screens by Band Classificat...

Recently the FCC opened a comment period regarding an AT&T petition to establish a mid-band spectrum screen. I thought this would be a good opportunity to look at the spectrum screen...

Evaluating Spectrum Screens by Band Classificat...

Recently the FCC opened a comment period regarding an AT&T petition to establish a mid-band spectrum screen. I thought this would be a good opportunity to look at the spectrum screen...

Market Spectrum Screens for the US National Car...

The recent news highlighting a FCC proceeding into the spectrum screen referenced, some analysis by Raymond James establishing T-Mobile dominance with 350MHz of spectrum on average in the nation's top markets....

Market Spectrum Screens for the US National Car...

The recent news highlighting a FCC proceeding into the spectrum screen referenced, some analysis by Raymond James establishing T-Mobile dominance with 350MHz of spectrum on average in the nation's top markets....