Spectrum Blog

Filter by

Tags ×

- 12.2GHz

- 1800MHz

- 2.5

- 2.5GHz

- 2100MHz

- 2300MHz

- 24GHz

- 2500MHz

- 28GHz

- 3.3GHz

- 3.45GHz

- 3.5GHz

- 31GHz

- 3500MHz

- 37GHz

- 39GHz

- 3GPP

- 47GHz

- 5G

- 600MHz

- 700MHz

- 800MHz

- 900MHz

- Agri-Valley Communication

- AllNet Labs

- AT&T

- ATNI

- ATT

- Auction

- Auction 105

- Auction 108

- Auction 110

- AWS

- AWS-3

- AWS2

- AWS3

- AWS4

- AWS5

- Axtel

- Band 38

- Band 41

- Band Class

- Bell Mobile

- Bell Mobility

- Bharti Airtel

- Blackrock

- Blue Ridge Wireless

- BNSL

- Bragg

- Broadband Incentive

- BRS

- BTA

- C Spire

- C-band

- CableOne

- Canada

- Carrier Aggregation

- Cass Cable

- Cavalier

- CBRS

- CBS

- Cellular

- Channel 51

- Channel Block

- Charter

- China Mobile

- Claro

- Clearwire

- Cogeco

- Columbia Capital

- Comcast

- Cox

- Cross Wireless

- Cypress

- Data

- DISH

- Dish Anywhere

- Duono

- Eastlink Wireless

- EBS

- EBS Auction

- Echostar

- EMBMS

- Ericsson

- FCC

- FDD-LTE

- FiberTower

- FirstNet

- Freedom

- Geneseo Communications

- GLG

- Globalstar

- Go Long Wireless

- Grain

- GSA

- Hawaii

- IFT

- Iowa Wireless

- Iris

- LAA

- Leap

- Liberty

- Licensed POPs

- LMDS

- LTE

- LTE Advance

- LTE Band

- LTE Band Class

- LTE Broadcast

- M&M Brothers

- MBS

- MetroPCS

- Mexico

- MHz-POPS

- Michigan Wireless

- Millimeter Wave

- MIMO

- MVDDS

- MVNO

- NextLink

- NFL

- Northstar

- NR

- NR Band Analysis

- Off-loading

- Orion Wireless

- PAL

- PCS

- PCS G

- PCS H

- Plateau Telecommunications

- PSA

- Qualcomm

- RCR

- Red Mayorista

- Reliance Jio

- Remapping

- Rogers

- RRH

- RSA Access

- Rulemaking

- Sagebrush Cellular

- SAS

- Sasktel

- Shenandoah

- Skyriver

- Small Cell

- Small Cells

- SNR

- Softbank

- SpaceX

- Spectrum

- Spectrum Ownership Analysis Tool

- Spectrum Ownership Mapping

- Spectrum Screen

- Spectrum Transactions

- SpectrumCo

- Sprint

- SSI Micro

- Starry

- Straight Path

- T-Mobile

- TBayTel

- TDD-LTE

- Telcel

- Telefonica

- Telmex

- Telus

- Terrestar

- TLPS

- Tribal

- TV Zac

- Ultravision

- United States

- Upper Microwave

- Usage

- USCellular

- Verizon

- Videotron

- Vodafone Idea

- VOIP

- VoLTE

- WCS

- Web Spectrum Viewer

- White Space

- Whitespace

- WiFi

- Xplore

- Xplornet

Strategic Decisions: When Spectrum Deals Emerge

Last week highlighted the importance of having access to a spectrum database and analysis tool that is capable of modeling announced transactions. There were several things that our customers were...

Strategic Decisions: When Spectrum Deals Emerge

Last week highlighted the importance of having access to a spectrum database and analysis tool that is capable of modeling announced transactions. There were several things that our customers were...

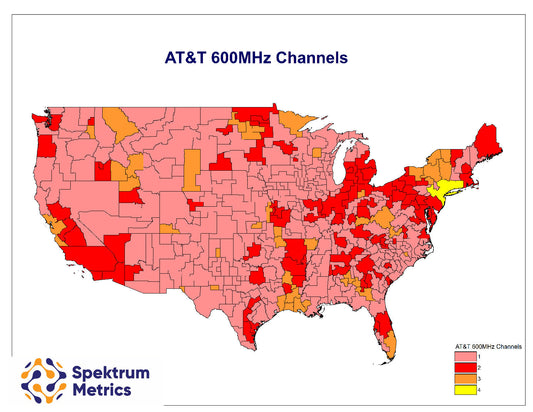

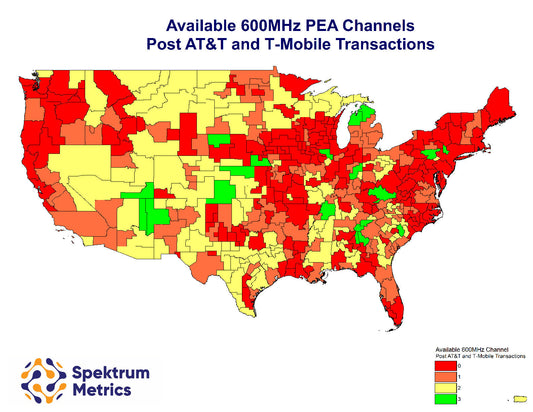

Comparing AT&T and T-Mobile's 600MHz Spectrum T...

Previously we looked at the the effect of the AT&T / Echostar deal to determine the remaining 600MHz channels that would not already be committed to AT&T or T-Mobile. In...

Comparing AT&T and T-Mobile's 600MHz Spectrum T...

Previously we looked at the the effect of the AT&T / Echostar deal to determine the remaining 600MHz channels that would not already be committed to AT&T or T-Mobile. In...

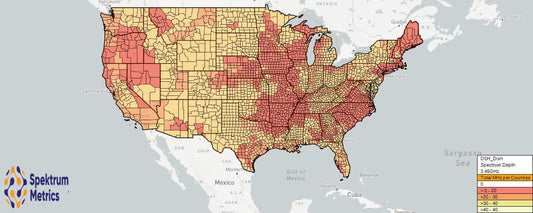

How Many 600MHz Channels Remain Available in Ea...

With AT&T's announced purchase of Echostar's 600MHz spectrum our first investigative blog post will evaluate the remaining channels of spectrum that are not controlled by AT&T or T-Mobile. In later...

How Many 600MHz Channels Remain Available in Ea...

With AT&T's announced purchase of Echostar's 600MHz spectrum our first investigative blog post will evaluate the remaining channels of spectrum that are not controlled by AT&T or T-Mobile. In later...

Looking at Vodafone Idea Using the Latest Spect...

Spektrum Metrics is excited to announce an expansion of our industry leading spectrum ownership analysis products to cover the Mobile Carrier (600MHz to 3.7GHz) frequency bands for India. The Mobile...

Looking at Vodafone Idea Using the Latest Spect...

Spektrum Metrics is excited to announce an expansion of our industry leading spectrum ownership analysis products to cover the Mobile Carrier (600MHz to 3.7GHz) frequency bands for India. The Mobile...

The Effect of Comcast's 600MHz Spectrum on T-Mo...

In Fierce Wireless' article on T-Mobile's initial lease of Comcast's 600MHz spectrum, there were 3 markets highlighted as "required" as part of the purchase agreement. These three markets are New...

The Effect of Comcast's 600MHz Spectrum on T-Mo...

In Fierce Wireless' article on T-Mobile's initial lease of Comcast's 600MHz spectrum, there were 3 markets highlighted as "required" as part of the purchase agreement. These three markets are New...

Which Licenses will T-Mobile Get from Columbia ...

A little over a week ago, T-Mobile announced that they were purchasing additional 600MHz spectrum from Columbia Capital. Immediately, we began receiving phone calls to determine which markets T-Mobile would...

Which Licenses will T-Mobile Get from Columbia ...

A little over a week ago, T-Mobile announced that they were purchasing additional 600MHz spectrum from Columbia Capital. Immediately, we began receiving phone calls to determine which markets T-Mobile would...